A beautiful irony?

TAKE AWAYS

Global inflation will become Commodity-driven

Global inflation will remain high for at least the next 10 years.

Coercive dependency will accelerate Fossil Commodity substitution

This month’s blog considers the sudden rise in global inflation, that the IMF predicts will be between 5.7 to 8.7% by the end of the year (World Economic Outlook, IMF 4/2022). Central Bankers and Financiers at Davos last week (Reuters Koranyi and Burns 24/5/22), suggested that the current increase will fall back – if not this year, then sometime in 2023, while Andrew Bailey, the Governor of the Bank of England testifying before a parliamentary committee (www.ft.com 16/5/22), stated that, ‘this period of high inflation will settle back next year’ . . . ‘towards the UK government target level of 2%’.

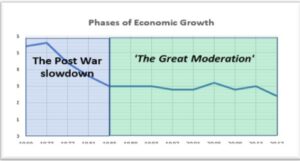

Behind these statements lies an unshakeable belief that by using the appropriate financial engineering, the World can return to the managed macroeconomic stability it has enjoyed for many decades – what Ben Bernanke and others described as the Great Moderation (see Figure 1).

Figure 1: Economic Growth 1969-2017 (10 yr. averaged)

But that perception of our economic future is in sharp contrast to the outlook of Segmented World Model over the next ten years, at least.

What does the Model predict?

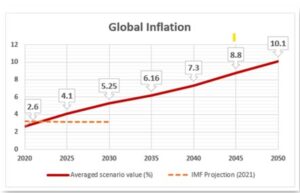

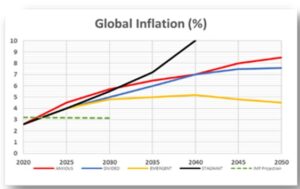

During the first period of the Model (mid-2020 to mid-2025) the ‘Averaged Curves’ provide the most reliable prediction of the representative parameters (see Dialogues, 1 and 6 for further discussion). Figure 2, below, shows the Averaged Curve for the Global Inflation parameter

Figure 2: Averaged global inflation curves from the four world outcomes

The main takeaway from this graph is that in the next ten years, global inflation will rise but remain single digit. It is worth noting the IMF’s prediction made in 2021, was consistent with a continuation of the low rates characteristic of the Great Moderation.

Why this disparity between the Model and the IMF predictions?

As the World moves into, what the Segmented World Project terms, The Time of Less (see Dialogues, thesegmentedworld.com), the three global drivers of Population, Pollution and Resource begin to play an increasing direct role in shaping the world’s economic, political and social futures. Over time, core global inflation shifts from demand-pull to cost-push but with an important qualification that the cost element is dominantly Raw Material-driven, in particular, the rising price of Fossil Commodities (i.e. Fossil energy, metals and minerals).

As a result, the level of inflation becomes increasingly tied to the availability of strategic raw materials, while controlling inflation (and managing economic growth) requires a return to hands-on political involvement in economic matters, as the monetary intervention approach of Central Bankers and financial agencies lose their effectiveness.

Before I expand on this point, I need to say a little more about the background to the Model’s inflation prediction.

How does the Model predict Global Inflation?

The prediction, of course, is part of the iterative process that uses a combination of historical, existing prediction, trend line analysis and, most importantly, scenario driven narrative. (see Something . . . is happening presentation on thesegmentedworld.substack and other media outlets, given at the end of this article, for more information)

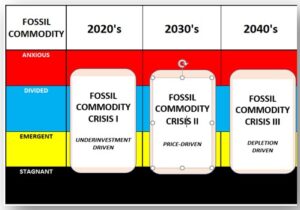

The most powerful contributor to this new form of inflation is the slow demise of strategically important Fossil Commodities. Integrating the reserve profiles of a wide range of strategically important Fossil Commodities, defined three generic crises over the next thirty years. (see Figure 3, below).

Figure 3: FOSSIL COMMODITY Crises: 2020-2050

The first of these – led by Fossil Energy – is already upon us. After a decade of discontinuous and falling investment caused by a combination of greening policies and the 2010’s oil price collapse, the World entered this decade with produced volumes far outstripping discovered. Even before the supply line disruptions caused by the Pandemic and now the war in Ukraine, many informed observers were predicting a Fossil Energy supply crunch in the 2020’s (Rystad Energy, 2020; Reuters 23/5/22; CEO Aramco speaking at Davos, last week).

The distinction between Crisis II and III is a matter of degree.

In none of the modelled outcomes are Fossil Commodities (e.g. copper, oil, Rare Earths etc.), rapidly replaced by widely available, low cost, renewable clean substitutes. The reason for this is a matter of scale.

- The scale of global investment in alternative raw material research has, until now, been inadequate. Shortages that provide an economic or political incentive, have been too short-lived to have any impact.

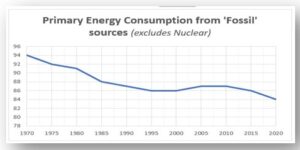

- The scale of globally replacing existing fossil-driven systems and processes is immense. A clear example of this is Fossil Energy (FE). Even today, with the added incentives of developing green alternatives, FE still accounts for 84% of World’s primary energy consumption. Even with a technical breakthrough occurring now, in say fusion power, it will take many decades to manufacture and distribute the alternative infrastructure and product, globally.

Figure 4: Change in Primary Energy Consumption from Fossil Fuels (BP Statistical Review 2020)

In the 2030’s, this absence of viable substitutes leads, in three of the Model outcomes, to one nation after another becoming ‘priced out’ from using Fossil Commodities. Instead they revert, particularly in the STAGNANT WORLD, to using biomass and local recycling, as is already seen in many impoverished parts today, (see Figure 16: Household Energy Consumption in Rural Pakistan Dialogue 2; thesegmentedworld.com).

In the 2040’s (though starting before then depending on the economic climate of the different Outcomes), strategic Fossil Commodities, one by one, begin to become ‘extinct’ as spiralling extraction costs, push prices to a point where the size of the global Market cannot support the cost of further exploitation.

How does the Segmented World cope with Commodity-driven inflation?

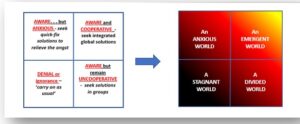

The four modelled Worlds adopt four different strategies, each dictated by the four generic behaviours – as shown in Figure 5, below. (For more detail please refer to the presentation ‘Something . . . is happening’)

Figure 5: Four dominant attitudes of the Four World Outcomes

Figure 6 gives the predictions of the Model for the four world outcomes.

Figure 6: Global Inflation for the Four World Outcomes

The only modelled outcome that achieves takes charge of inflation, in the thirty-year timeframe, is the EMERGENT WORLD. This world wins through because of an upward shift in the degree of global cooperation that not only lifts the level of Focussed Innovation but also provides the global management required to ensure an adequate supply of Fossil Commodities until viable alternatives can be rolled out.

How likely is it that the World today could organise itself in such a way?

In the light of the RUSSO-BLOCK’s recent actions, such an outcome seems unlikely. The shock of RUSSO-BLOCK’s brutality is only exceeded by the realisation that such actions are passively supported by governments representing over half of humanity. This pro Democratic-pro Autocratic split, points to a DIVIDED rather than an EMERGENT WORLD outcome (see Figures 5 and 6). Moreover, a major Fossil Commodity producer has exposed a critical downside to current globalisation model as it exploited the inherent dependency in the system to selfishly advance its geopolitical ambitions. (see Segmented World Perspective Blog, April 2022: Globalisation is dead . . . and so?)

However, from the perspective of the Segmented World Model, the game changing action of the RUSSO-BLOCK’s invasion, was not one of military threat but the global recognition that one of World’s few remaining storehouses of raw materials may no longer be freely available for trade.

This is a very dangerous strategy – not just for the RUSSO-BLOCK but for the World, as a whole. When, in the 1990’s, Saddam Hussein made a similar threat by blocking the free flow of Middle East oil through the Straits of Hormuz, the reaction was swift and uncompromising. As much as the war was criticised, Saddam’s actions left little alternative as he threatened the economic viability of a Powerblock that, as the EU-BLOCK is today with the RUSSO-BLOCK – was then massively dependant on the flow of Middle East Oil.

But Iraq did not have 6257 nuclear warheads.

This has left those, openly opposed to the RUSSO-BLOCK’s actions, little choice but to seek ways to urgently reduce their dependency on the RUSSO-BLOCK storehouse by speeding up the development of Fossil Commodity substitutes that are, at the same time, cheaper and kinder to the planet.

How does Focused Innovation take-off

Is this the way that Focused Innovation will take-off? The American psychologist Kenneth Kaye certainty thought so when he said: ‘If necessity may be the mother of invention, conflict is its father.’

It is not the role of a Model to predict, in any detail, the way in which the world will solve its problems. I can be confident Liverpool FC will come close to the top of the Premier League next year but predicting which matches they will lose or their final points tally is something to exercise the minds of clairvoyants rather than modellers.

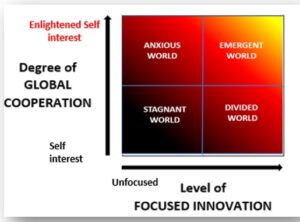

So too with the Segmented World Model. It is reasonable to assume that the degree of Global Cooperation and level of Focussed Innovation will be deciding factors in determining what type of world will emerge in the future but how this will be achieved will only be discovered by closely examining current events. That is the main purpose of the Segmented World Perspective blog.

Figure 7: The GC-FI Matrix of the Segmented World Model

Are there any signs that Focused Innovation has increased?

It is early days – the RUSSO-BLOCK only revealed its expansionist intentions three months ago. However, already I have noticed since the war began, a slew of new proposals many of which were initially created in response to ‘green’ concerns but have now been turbo-charged by the threat of raw material shortage and the higher price bar.

The UK offers a few examples. One is an ambitious, 2360-mile-long, high voltage cable from Morocco to Devon in the UK, delivering, at half the cost, the equivalent of two medium-sized nuclear power stations, from a vast array of solar panels (covering area about the size of Hertfordshire) in the Sahara, supported by wind power on the coast (Global Construction Review 2021; DT 5/22).

Figure 8: Xlinks Morocco-UK Power Project

Added to that are the many smaller projects that, until now. have been held up by parochial, vote-sensitive, objections. The RUSSO-BLOCK threat has provided a new context for reconsidering these proposals, centred on the national need for securing strategically important commodities. In the case of energy security, these include new investment in tidal stream power around the UK (www.gov.uk 24/11/21) capable of providing 11% of UK’s power by the end of the decade; a reconsideration of planning laws regarding land-based wind farms (DT, 23/3/22) and a more favourable climate for developing the UK’s remaining indigenous oil and gas reserves on and offshore (Sky Climate Change report 30/3/22), in order to provide the fossil fuels required for a socially acceptable energy transition.

Such initiatives could be bought together by the pro Democratic members of the G20 – sharing ideas to create a wider global response. It would be a start towards moving the world in the right direction, albeit triggered by conflict and, at present, more indicative of a DIVIDED than the EMERGENT outcome.

It would also be a beautiful irony if the longest lasting, legacy of the Ukrainian war were a global acceleration in the substitution of the very Fossil Commodities that the RUSSO BLOCK’s uses to fund its medieval actions.

David

27/5/22

thesegmentedworld.com; @thesegmentedwo1; www.linkedin.com/in/david-francis-nash; thesegmentedworld.substack.